Alana Burton is a Financial Advisor based in Peterborough, Ontario. Alana has been practicing in the financial field since 2017 and enjoys helping her clients define and achieve their own individual accomplishments, whether it is buying a cottage or a first home or structuring their retirement. Alana joins our community due to her personal alignment with Random Acts of Green and our mission.

Below we have asked Alana to share her expertise surrounding sustainable investment and why it is important!

Why is Sustainable Investing important today?

Interest in responsible investing has been accelerating over the past 50 years. At first, it was about investing with values in mind, but the enthusiasm for this approach goes well beyond that today.

Research suggests companies with strong responsible investing credentials tend to be more resilient during market crises. The investment world has started to notice, and demand is growing. 72% of Canadians are interested in responsible investing

How do you approach Sustainable Investing?

Investors demand, people like you want the opportunity to enjoy financial gains while also helping make positive change in the world.

Can you describe the most recent and popular sustainable investing trends in the banking sector today?

- Investors care about making the world a better place. 72% of Canadians are interested in responsible investing but only 28% of advisors are having the responsible investing conversation.1 How do you target the right clients for this opportunity? One group, in particular, is looking to invest for returns while reshaping the future – millennials

- Millennials aren’t children anymore. They’re growing up, their financial needs are changing and they’re investing in companies that are doing good in the world – so they can see a future for their own children and life as they know it. It’s time to talk to millennials about their financial plan and how responsible investments might fit.

- Millennials are set to inherit the largest wealth transfer in Canadian history –approximately $1 trillion – by 2028, leaving them with more money. You can be the advisor to help them plan what to do with that money.

How is Responsible Investing (RI) is growing in Canada and the United States

Investors want to use their money to support legislation that consider ESG factors when making investment decisions. Here are two examples:

- In Canada, the Government of Canada launched the Sustainable Finance Action Council to help lead the Canadian financial sector towards integrating sustainable finance into standard industry practice.

- In the United States, they implemented the Sustainable Investment Policies Act.

What are some sustainable investing incentives that Canada Life currently offer?

At Canada Life, aligning with current regulations and the highest ethical standards is paramount. We’re also committed to bringing quality, best-in-class investment solutions to the marketplace that help meet clients’ needs through today’s changing market dynamics.

“Canada Life incorporates responsible investing at two levels – in its use of ESG elements to assess fund managers and funds, and by offering select sophisticated investment solutions designed with both responsible investing and fund performance in mind,” says Brent MacLellan, VP Portfolio Construction and Analysis.

principles for responsible investment

what is sustainable investing

More Blog Posts:

The Guide to Veganuary!

Whether you are going full vegan or starting to eat less meat, our guide to veganuary will help you go plant-based in 2023.

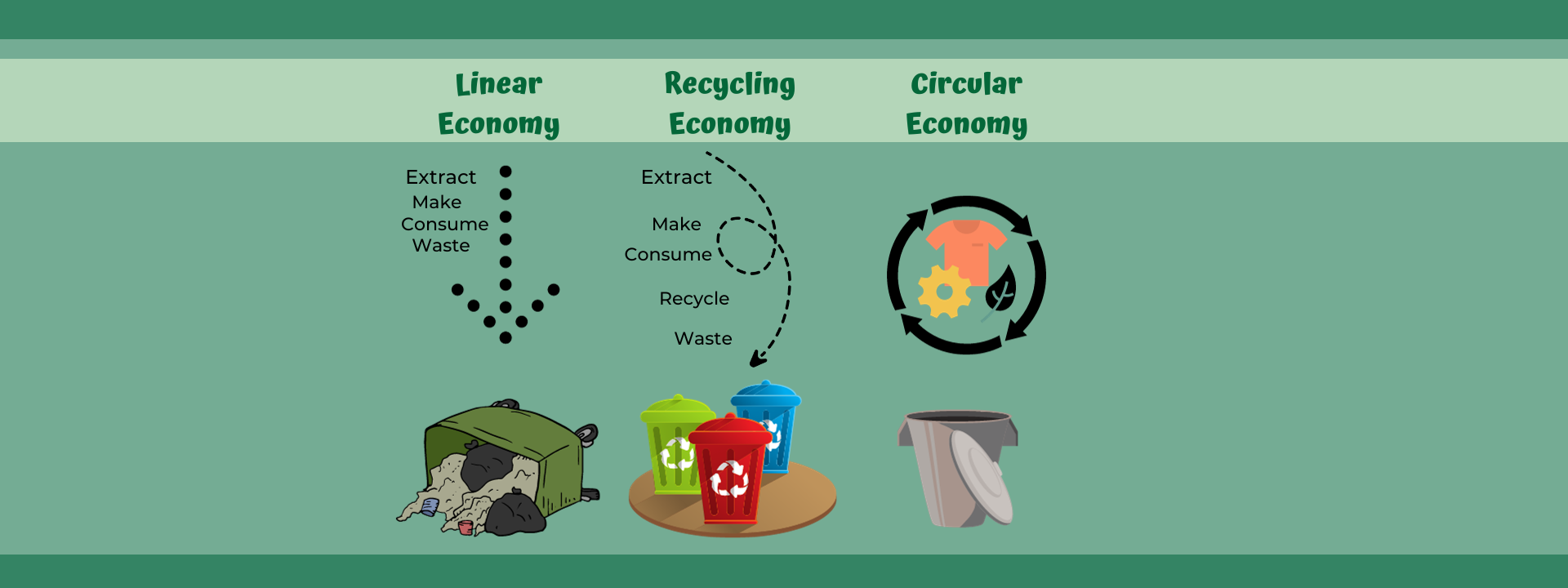

5 Circular Economy Companies in Canada To Celebrate Waste Reduction Week

Say hello to 6 Circular Economy Companies in Canada this October as we Celebrate innovators during Waste Reduction Week.